34+ Mortgage loan insurance calculator

Life insurance or life assurance especially in the Commonwealth of Nations is a contract between an insurance policy holder and an insurer or assurer where the insurer promises to pay a designated beneficiary a sum of money upon the death of an insured person often the policy holder. MHC Mortgage Insurance Calculator.

Fha Loan Calculator Fha Mortgage Rates Limits Qualification Information Fha Loans Refinancing Mortgage Mortgage Loans

Included in the calculator are features unique to the USDA loan including the USDAs upfront mortgage insurance and annual fees.

. Many other variables can influence your monthly mortgage payment including the length of your loan your local property tax rate and whether you have to pay private mortgage insurance. You can also manually edit any of these fees in the tax insurance HOA Fees section of this page. Home to qualify for a home equity loan.

This may go beyond the term of the loan. With a capital and interest option you pay off the loan as well as the interest on it. Mortgage calculator results are based upon conventional program guidelines.

Down Payment CMHC Insurance Premium. Second mortgages come in two main forms home equity loans and home equity lines of credit. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

Our home loan calculator accounts for all the essential conditions that will affect mortgage costs including loan type loan amount down payment interest rate and more. See a snapshot of student loan debt in America. Furthermore compared to a 30-year FRM you save tens and thousands on interest charges with a 15-year FRM.

When you take out a mortgage youre likely to receive offers of mortgage protection insurance. To providing mortgage loan insurance for those looking to buy a home. The offers may come from your lender or from independent insurance companies.

The loan is secured on the borrowers property through a process. Historical Mortgage Rates A collection of day-by-day rates and analysis. Second mortgage types Lump sum.

People typically move homes or refinance about every 5 to 7 years. Button in the above calculator after entering your loan detals. Current Mortgage Rates Up-to-date mortgage rate data based on originated loans.

Right from the word go Matt was able to get us the best advice on the types of insurance available that would fit our requirements. This calculator provides those searching in rural and semi-rural areas a way to quickly and easily estimate their monthly payments with a USDA loan. Calculate your monthly payment here.

Borrowers between the ages of 25 and 34 carry about 500 billion in federal student loansthe majority of people in. With mortgage protection insurance if you die the insurance is paid directly to the lender to pay off the loan. If a person.

Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older. Use SmartAssets free Pennsylvania mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. Vacant Land Loan Calculator to calculate monthly mortgage payments with a land contract amortization schedule.

Insurance Premiums For Different Down Payments. All uses of Best Egg refer to the Best Egg personal loan the Best Egg Secured Loan andor Best Egg on behalf of Cross River Bank or Blue Ridge Bank as originator of the. Actual payment could include escrow for insurance and property taxes plus private.

Use SmartAssets free Texas mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. Depending on the contract other events such as terminal illness or critical illness can. He works quickly - both in responding to any queries we had and in pulling applications together.

The appraisal is done for. The early mortgage payoff calculator does not take into account other fees such as tax and insurance as well as private. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property.

Here are some of the advantages of a 15-year mortgage over a 30-year mortgage. Build home equity much faster. Other loan programs are available.

At the end of the mortgage term the original loan will still need to be paid back. 15-year FRMs also come with lower rates by around 025 to 1 than 30-year FRMs. Across the United States 88 of home buyers finance their purchases with a mortgage.

This calculator will compute a mortgages monthly payment amount based on the principal amount borrowed the length of the loan and the annual interest rate. Matt was recommended to me and my partner by our mortgage broker. Amortization Period - The actual number of years it will take to repay a mortgage loan in full.

The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments. Best Mortgage Lenders Independently researched and ranked mortgage lenders. 3499 35 or greater.

The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. 15-year fixed home equity loan. Loan Prepayment Calculator to calculate how much you can save in total interest payments with mortgage prepayment and early payoff.

For instance mortgage insurance premium MIP for FHA loans is also cheaper if you choose a 15-year fixed FHA loan. Further review by a professional is necessary to obtain exact and complete information and available options for your personal circumstances. You can also manually edit any of these fees in the tax insurance HOA Fees section of.

We really couldnt have asked for more from Matt. Interest can add tens of thousands of dollars to the total cost you repay and in the early years of your loan the majority of your payment will be interest. The calculator only provides preliminary estimates based on information you enter and such factors as current interest rates credit score and a debt-to-income ratio.

While both loan types have similar interest rate profiles the 15-year loan typically offers a slightly lower rate to the 30-year loan. The mortgage should be fully paid off by the end of the full mortgage term. For example mortgages often have five-year terms but 25-year amortization periods.

What does mortgage protection insurance cover. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Appraised Value - An estimate of the value of the property offered as security for a mortgage loan.

Estimating monthly mortgage payments is an excellent way of getting. The lesser one is your taxes and insurance while the larger one is the principal and interest on its own. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

With an interest only mortgage you are not actually paying off any of the loan. Home Equity Loan Payoff Calculator Mortgage Insurance Calculator Amortization Schedule With Irregular Payments. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

Flood insurance and mortgage tax if you repay and terminate the loan within 36 months. Mortgage insurance and homeowners fees using loan limits and figures based on your location. Mortgage Calculator Found a home you like.

Mortgage insurance and homeowners fees using loan limits and figures based on your location.

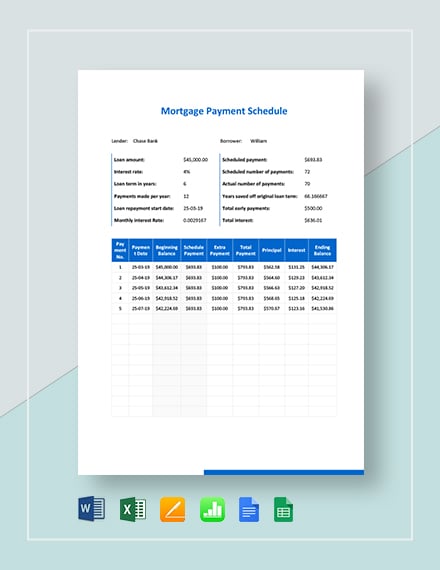

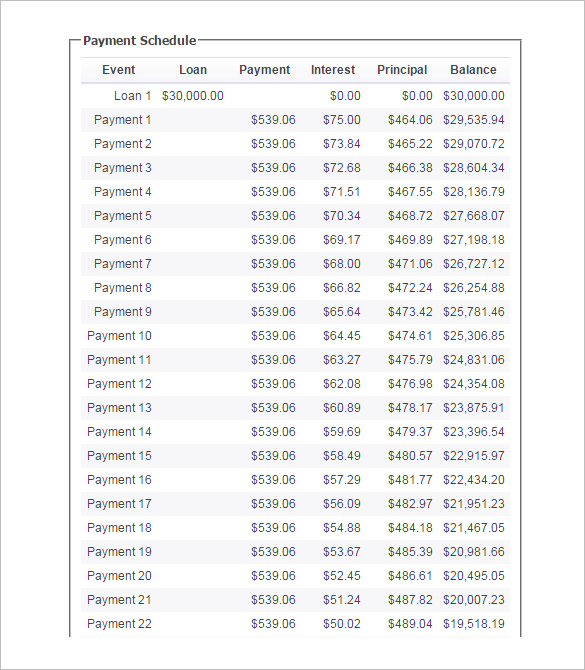

Mortgage Payment Schedule 5 Free Excel Pdf Documents Download Free Premium Templates

Mortgage Payment Schedule 5 Free Excel Pdf Documents Download Free Premium Templates

Calculate Mortgage Rates With The Mortgage Calculator Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Loan Calculator

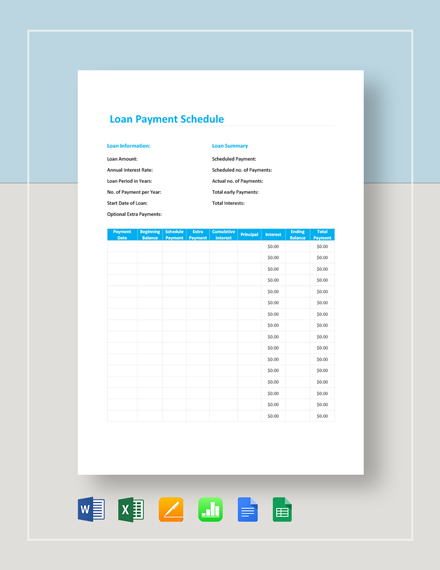

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

Microsoft Access Mortgage Insurance Loan Calculator Form Templates For Microsoft Access 201 Mortgage Loan Calculator Loan Calculator Document Management System

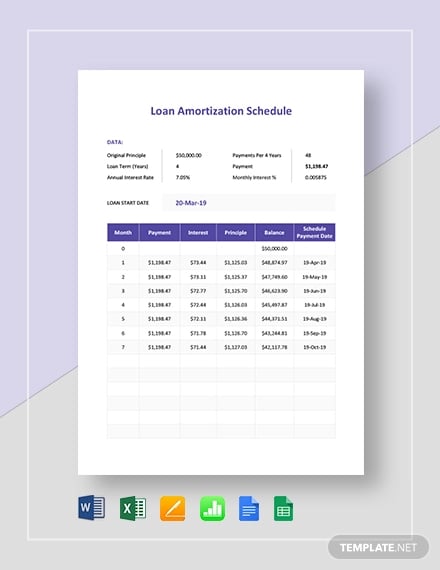

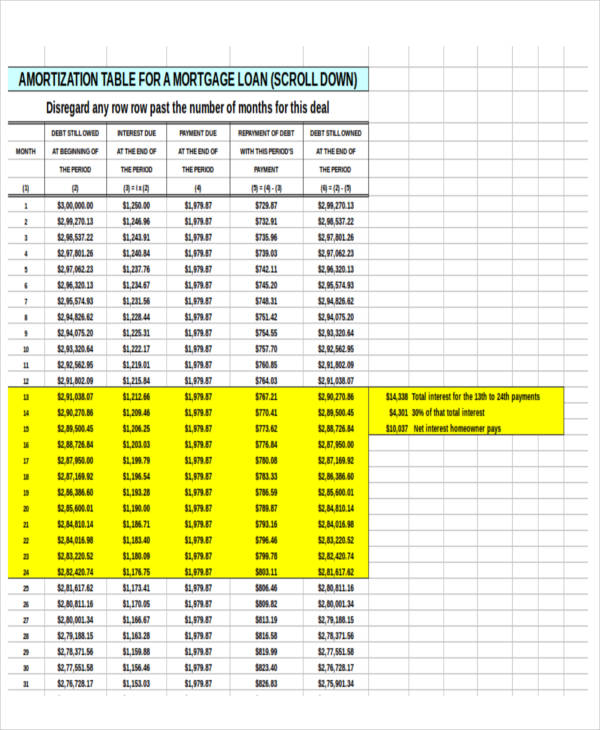

9 Loan Amortization Schedule Template 7 Free Excel Pdf Documents Download Free Premium Templates

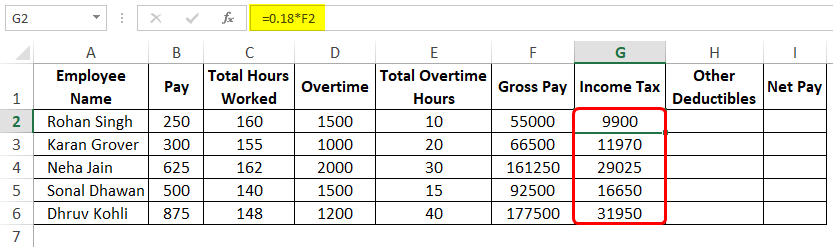

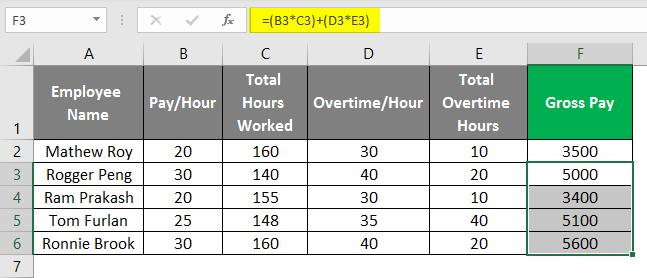

Excel Template For Payroll How To Create Payroll Template In Excel

Fha Home Loan Calculator Easily Estimate The Monthly Fha Mortgage Payment With Taxes Mortgage Loan Calculator Fha Mortgage Mortgage Amortization Calculator

Use The Interactive Online Emi Calculator To Calculate Your Home Loan Emi Get All Details On Inter Life Insurance Premium Life Insurance Calculator Income Tax

Mortgage Calculation With A Mortgage Comparison Calculator Mls Mortgage Mortgage Loan Calculator Mortgage Comparison Mortgage Estimator

Payroll In Excel How To Create Payroll In Excel With Steps

How Much Is Pmi Insurance Private Mortgage Insurance Pmi Insurance Mortgage

12 Loan Payment Schedule Templates Free Word Excel Pdf Format Download Free Premium Templates

Mortgage Insurance Vs Life Insurance Mortgage Protection Insurance Life Insurance Policy Life Insurance Companies

8 Car Loan Amortization Schedules Google Docs Apple Pages Ms Word Free Premium Templates

Mortgage Payment Calculator Calculate Your Ideal Payment Mortgage Payment Calculator Mortgage Payment Mortgage

34 Sample Budget Calculators In Pdf Ms Word